By Dale Vile

The notion of cloud computing taking more of the action in the market raises a number of concerns for resellers, system integrators and others in the IT channel.

Service providers attempting to sell directly to end-user organisations can create confusion, and misguided direct models can give rise to unsustainably low price expectations, leaving little room to manoeuvre margin-wise when the provider eventually figures out that the channel is important to success after all. There is then the concern, particularly among resellers, of cloud cannibalising existing product revenues. The fear is that solid upfront payments from customers for hardware and software will be replaced by income that drips in over an extended period of time and ultimately adds up to less.

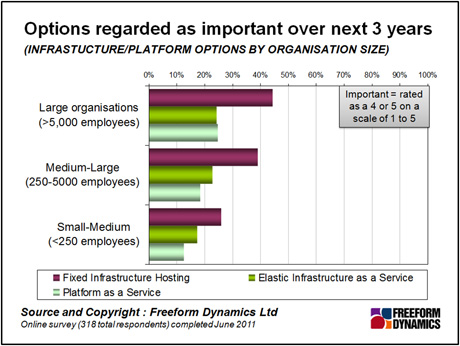

Whether it makes sense to embrace the cloud hosting model as part of your core business sooner rather than later depends on what you are selling and to what types of organisation. If you are delivering more complex software applications that lend themselves better to on-premise deployment because of integration requirements, for example, then there is arguably less need to rush. If the centre of gravity of your business is commodity software, though, then it’s worth looking at utility service alternatives sooner since this where a lot of the early cloud action is starting to unfold (Figure 1).

Figure 1

The appetite for utility-style software as a service (Utility SaaS), by which we mean services that can be adopted with relatively little customisation and integration, might pose a threat to some, but can also represent an incremental opportunity.

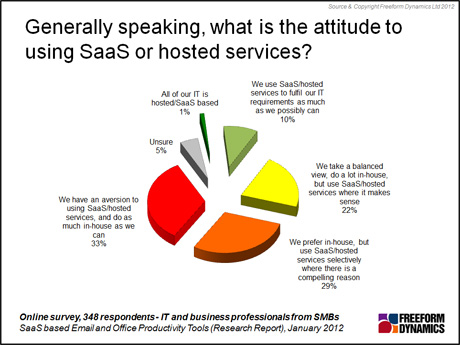

The key point here is that such services often complement on-premise solutions very nicely, which is interesting when you consider that many customers tell us they are taking a blended approach to meeting their IT needs, working SaaS options into the mix selectively (Figure 2).

Figure 2

The upshot is a clear cross-sell opportunity.

An example here might be working something like Mimecast’s email archiving service into the deal as part of an Exchange upgrade exercise. Archiving is a generally underappreciated and poorly understood solution area that relatively few IT professionals beyond large enterprises even think about. Cloud based archiving is easy to understand and buy, however, and can also deliver added benefits into the bargain. With Mimecast, for instance, it’s possible to provide users with access to the cloud-based repository of all their historical email via laptops, slates and smart phones. This reduces the need for huge PST files and other local email stores, which in turn lowers management overhead as well as improving security. So, potentially quite a compelling cross-sell right there.

Of course there are other channel-friendly players that deliver data management and data protection services. Symantec is one of these, and some of the things it has been doing lately directly address the kind of cross-sell opportunities we have been discussing. Apart from neutralising the commercial impact of choosing between a cloud and on premise deployment, it has created a single portal (that partners can optionally control) which brings multiple services together in one place. Whether you start with data protection or end point security as part of a cross-sell from a desktop upgrade deal, the idea is that new cloud functionality can simply be switched on with the minimum of fuss, paperwork and immediate cost.

A less intuitive example of an on-premise to cloud cross-sell opportunity is from a server deal to Office 365, which sounds a little odd until you consider that Windows Server 2012 comes out of the box with a set of hooks into Microsoft’s cloud service offerings. You may not be able to persuade the customer to go for a full blown Exchange upgrade, but by positioning a cloud service with greater functionality as something you can include as you refresh part of their broader server landscape, you might just get a bite.

These are just a few examples associated with mainstream vendors to give you a flavour of what’s possible as the market for more utility-style SaaS develops. There are also opportunities emerging as new, innovative providers look for channel representation. A couple that spring to mind here are Mindjet with its lightweight project/work management solution, a good cross-sell from a Microsoft desktop upgrade, and Moorepay, with its Moorepayhr service that includes access to HR and payroll expertise so you can move up the value stack without having to worry as much about the specialist business skills.

The important point in all of this is that it’s incremental business, giving you a chance to embrace cloud options, take advantage of both annuity based margin and spin off support and professional services revenue, while minimising disruption to your core revenue streams.

CLICK HERE TO VIEW ORIGINAL PUBLISHED ON