It seems that mobile operators are doing something right. According to the results from our recent mobile poll, a pretty convincing majority – close on 80% of you – have told us that you would be happy to recommend your provider.

And it would seem that when it is good, it can be very good. Quotes such as the one from this Reg reader were not atypical: “Our provider has always supplied us with a good service, when we have had problems we have been dealt with in a professional and efficient manner.”

On the basis of comments like this, it would be very easy to assume that all is well in the world of mobile provision. Some, however, were more qualified in their praise:

Reasonable service, and good price/performance balance. Probably the best I’ve experienced, but the industry average is woefully low.

What we have does work – internal extension numbers for mobile end points, integrated billing for private/business. But coverage could be better, and many users are on very basic handsets.

Solid performer, but can be slow to adapt, and to put customer needs first.

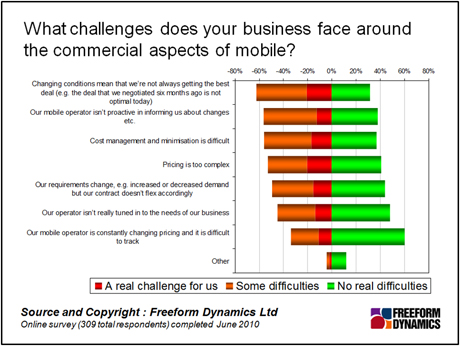

Of course, nothing is perfect and a few less than totally positive comments do not necessarily indicate a problem. However, when we drilled a little deeper below these high level impressions, the responses suggested a number of underlying problems, which, while not crippling for everyone, were highlighted as significant areas of dissatisfaction by quite a few readers.

At forty thousand feet level, being able to easily flush out mobile operator challenges in this way, when people are reminded of some of the areas that have a tangible effect on business users, suggests that many of us have lowered our expectations over the years. Put simply, when people say they would recommend their provider to others, the spirit behind this undoubtedly in many cases is that they are the lesser of all evils in their experience.

Looking at some of the specific shortcomings, the area that presents most problems for businesses is that of changing terms, which means that a deal negotiated previously is often not optimal today. This is a particularly frustrating problem for companies, as they observe mobile operators releasing ever more attractive packages that they find themselves unable to access, because they are locked into an existing two year contract which still has twelve months to run.

And on this note, it is worth pointing out that mobile contracts are increasing in length, driven by the operators’ desire to tie customers in longer. Whether this is for sinister motivations or simply because of the need to extend the contract period in order to balance the books on heavily subsidised smartphones, is less important than the negative consequences of perceived inflexibility when contracts are dragged out for longer than businesses would ideally like.

So it is often a case of put up and shut up, unless companies have been able to negotiate a specific clause into the contract that allows for dynamic reviews of pricing and service features, or better still, a benchmarking clause that tests how the operator performs against the market, and allows for retrospective adjustments and penalty payments if they fall short of the mark.

Unfortunately, such negotiations are often for the preserve of very large enterprises, and even then, they can be notoriously difficult to agree, and don’t always deliver satisfactory conditions. As one reader from a large public sector organisation told us:

Pricing is via a defined overarching framework and doesn’t really meet our requirements. Ideally we would want to negotiate a ’total combined cost’ for data traffic for all handsets, as some users barely use data, others are heavy users, but the contracts are not flexible enough to reflect this.

And if such negotiations are tough for large enterprises, it’s guaranteed they would be a minefield for smaller businesses, even if the operators were willing to discuss it.

Related to the above, which basically comes down to a question of value for money over the course of the relationship, another issue for businesses is that their mobile operators are simply not proactive about informing them of changes that might have a tangible impact on cost or benefit. For example, think about a provider introducing a per call connection charge, or altering the rules around their fair use policy, but ‘hiding’ the changes in the headache-inducing small print that it knows many companies won’t delve into, until they’re hit with the fallout of the change. To quote one very disgruntled Reg reader:

Everything is geared towards total obfuscation in an attempt to trick people into paying more than they need.

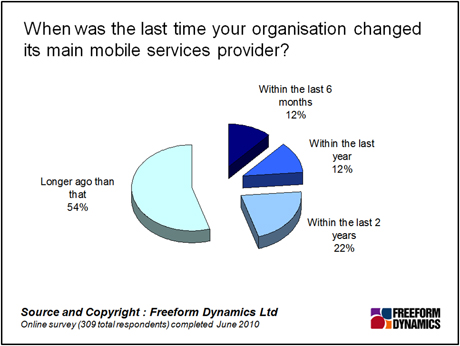

But maybe we shouldn’t be too hard on the poor old operators. Most of them appear to be delivering on the basics as you tell us, and just like any other business, it is their job to make money for their shareholders. And if we were that worried, then why have so many of us stayed with our current operator for so long?.

Some argue that this is partially down to lack of choice, in that service levels and terms do not vary significantly enough between operators for it to be worthwhile switching. More to the point, however, is that what we see here is a very backwards looking or historical view.

Even if we have not done much about our gripes and moans in the past, with a growing proportion of the communications budget going on mobile, and user expectations continuing to escalate around mobile applications, services and devices, we are likely to be turning to operators for a lot more in the future. Revisiting your contract on a regular basis, rather than waiting until renewal time, therefore might be good idea in many cases, particularly if it has been a while since you have checked whether your current arrangements continue to meet the needs of your evolving business. And if this can be done with your mobile provider in the same room, so much the better.

But of course, any review of external services only makes sense if it is done in conjunction with an internal review of requirements. Looking at areas such as how employees are using mobile services, and how this is changing, in terms of things such as international roaming or data usage may have a significant bearing on your contract, and will provide the basis for a renegotiation.

Of course, not all operators may necessarily play ball and sit down mid contract. If you are happy with that, fine. But if not, it is worth remembering that your business is probably only a year away from the contract end, and that just might help focus the discussion for them. What have your experiences been with mobile operators in getting what you need, even when your needs change? Have they been happy to listen to you, or have things not gone quite to plan? And if so, how did you get things back on track? We would be interested in hearing from you.

Have You Read This?

Generative AI Checkpoint

From Barcode Scanning to Smart Data Capture

Beyond the Barcode: Smart Data Capture

The Evolving Role of Converged Infrastructure in Modern IT

Evaluating the Potential of Hyper-Converged Storage

Kubernetes as an enterprise multi-cloud enabler

A CX perspective on the Contact Centre

Automation of SAP Master Data Management