Developments in both the worlds of PC technology and the global economic climate have conspired to slow down much of the “routine” desktop upgrade cycle that takes place periodically in most organisations.

The combination of Windows Vista and the financial meltdown combined to push many refresh projects onto the back burner, but today there are indications that organisations are again ready to update much of the desktop and laptop footprints they operate.

Everyone knows that desktop refresh projects are complicated. Whatever the solution chosen however, the important matter of exactly how the project will be paid for is frequently overlooked, at least until all of the technological options are evaluated and project implementation is being planned. But does the current climate, especially the difficulties associated with any form of capital spending, offer an opportunity to investigate alternative ways to fund IT operations in general, and desktop refresh projects and ongoing operations in particular?

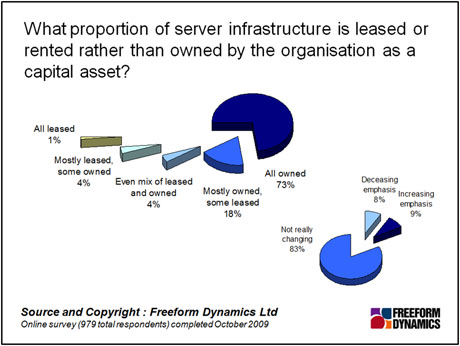

It is interesting that, despite the harsh economic climate and tight constraints on all forms of capital expenditure, research carried out last year by Freeform Dynamics highlights that organisations still consider paying upfront and “owning” their IT equipment to be the default approach. Whilst the figure below is looking at the server side of IT, there is no reason to believe that attitudes for paying for desktop solutions differ in any material way.

As can be seen from these results, fewer than one organisation in ten have more than an even mix of leased and owned kit, whilst almost three-quarters have systems that are entirely owned by the business. The results here, along with other research we have carried out recently, show that the proportion of kit entirely capitalised by the business is not expected to alter greatly in the near future, with IT managers expecting there to be only a slight reduction in the proportion of directly company-owned kit.

New models for the financing of both IT projects and ongoing IT operations deserve to be investigated as they could open up considerable opportunities to extend IT usage with considerable business benefit whilst minimising the risk associated with longer-term capital investments.

The reluctance to use alternative models of financing IT solutions however, even in times of great economic stress, is interesting as there is clearly a lot of noise in businesses about the need to reduce all forms of capital expenditure. In truth, in the majority of organisations it is likely that the CAPEX budget is far less than OPEX expenses. Equally, all IT spending on equipment, whether upfront, financed or leased, requires approval at initiation and therefore is always difficult to get. And once approved, it is always better to ensure that the budget is spent on schedule lest it be taken away.

One possible explanation for the relatively low use of leasing, project financing, managed services, outsourced offerings and other financial arrangements could be the simple fact that few IT managers, or the resellers that supply them, have much knowledge of the various options that might be available to them.

It could also be argued that many of the larger vendors that posses significant IT financing services do not do enough to either promote their use or educate potential customers on how these financial models work or where they may prove to be attractive. In many discussions alternative financing options are only brought forward when the customer says towards the end of the sales cycle / solution negotiations, “Ah, we don’t have quite enough in the budget to pay for this”, or more likely “We like what you are saying, but can you give us a bit more discount?”

Working out the budget for any IT project is complex and can sometimes involve significant use of intuition and “best-estimate” calculations, sometimes acknowledged to be little more than “guess work”. This makes capital-based budgeting difficult, especially if the ongoing management and maintenance costs are in any way uncertain.

The current round of desktop refresh investigations may encounter just such elements of doubt, especially if any of the desktop virtualisations are to be considered. The wide range of options available today beyond doing traditional “like-for-like” refresh replacements may bring into the equation more creative financing options, be they in the form of leasing or some form of managed services.

It will also be interesting to monitor the uptake of different financing models if organisations start looking at any form of pay-per-use solution in the IT infrastructure; but changes such as this may also require wholesale alterations to business – IT budgeting relationships, which do not change with any rapidity at all. After all, getting all parties to accept new models for the financing of IT will take a lot of work and political negotiations between IT, business units and finance departments, matters that cannot take place overnight.

Through our research and insights, we help bridge the gap between technology buyers and sellers.

Have You Read This?

Generative AI Checkpoint

From Barcode Scanning to Smart Data Capture

Beyond the Barcode: Smart Data Capture

The Evolving Role of Converged Infrastructure in Modern IT

Evaluating the Potential of Hyper-Converged Storage

Kubernetes as an enterprise multi-cloud enabler

A CX perspective on the Contact Centre

Automation of SAP Master Data Management