As businesses and consumers place increasing emphasis on the use of mobile, and both behaviour and expectations evolve around mobile offerings, it’s imperative for mobile operators to keep up with subscriber needs and demands, both at an aggregate and individual level.

This theme, explored extensively in the Freeform Dynamics’ report, Mobile Marketing Imperatives: Transitioning to a customer-centric approach, has emerged once again as a key outcome in research recently conducted on the factors affecting mobile service uptake.

The research findings – Moments of Need: factors affecting mobile service uptake – are based on information from in-depth telephone interviews of 362 business professionals in Germany, Spain, the UK and US.

One finding that comes out of this latest tranche of research centres around how usage patterns evolve from initial use of mobile, with some interesting correlations between the length of time and depth that users access services and their propensity to adopt other services.

Looking across a number of typical mobile usage scenarios, such as communicating with others, browsing web content and playing games or listening to music, and applying these to a particular context – a working trip away, for example, or a shopping trip – was very revealing.

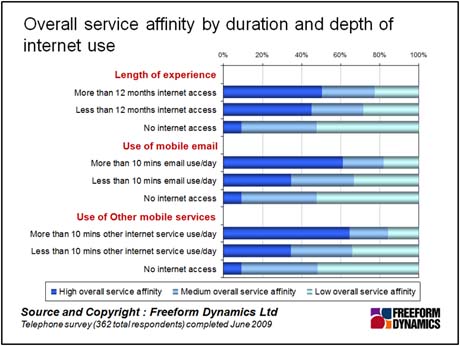

Firstly, the period of time a subscriber has been using internet services on their device does not significantly impact their likely uptake of other services. So a subscriber who has been using mobile internet for, say more than 12 months is no more likely to subscribe to additional services than a subscriber who has been using the same service for only a month.

On the other hand, frequency of use of mobile email or other mobile internet services has a significant impact on service affinity – the likelihood that a subscriber will migrate across to other services.

What that means in practice is that intense users exhibit a higher degree of interest in a broader range of service capabilities. This is illustrated in this chart below:

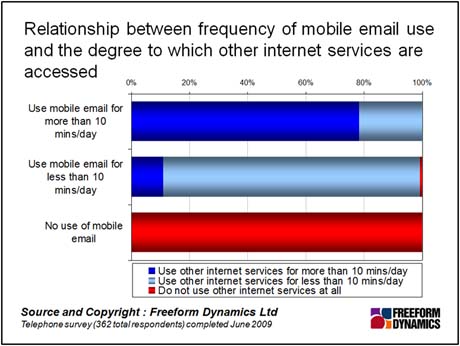

This is further reinforced when we consider the relationship between frequency of mobile email use and the degree to which other internet services are accessed – as illustrated in the chart below.

Subscribers who use mobile email for more than 10 minutes per day are much more likely to use other internet services deeply (i.e. for more than 10 minutes per day).

Conversely, subscribers with much shorter daily email use are, in general, unlikely to access internet services for other than very short periods.

The lesson here is that it won’t be enough in many cases for the mobile operators to just offer the subscribers a set of services that broadly match their needs, and then rely on them experimenting casually. This is unlikely to reap any significant benefits.

Rather, the more proactive encouragement of initial habit-forming behaviour around lead services such as mobile email is much more likely to unlock incremental value for the subscriber as well as drive better service uptake as part of improving overall business performance for operators themselves.

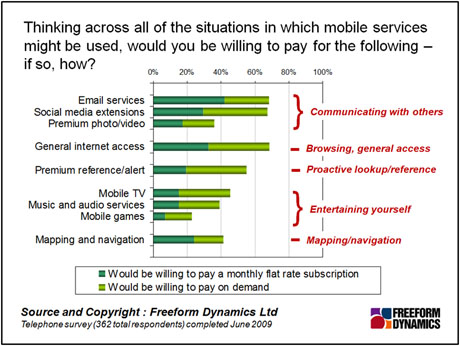

An important underlying point that must not be ignored here is the degree to which a subscriber is willing to pay for what is offered, and what the payment model would look like – for example, on demand or subscription-based; if subscription-based, as part of a bundle or as an individual service. This is illustrated in the chart below.

Beyond traditional voice and text, users have a high willingness to pay for communicating with others via email, social media extensions and photo/video sharing but information and entertainment services are increasingly of interest.

It’s important to note, however, that mobile users are not homogenous in regards to propensity to pay, and factors such as age and gender can have a big impact. Different groups of subscribers exhibit interest in a different mix of services and within that mix, they are prepared to pay for different elements in different ways.

An extension of the analysis around willingness to pay needs to address what level of additional cost users are willing to bear for any additional services.

What these findings suggest is that there is a need for mobile operators to continue their journey away from a service-centric view of the world to more of a customer-centric one in which the needs and behaviour of the subscriber are considered holistically.

Additionally, from an investment and measurement perspective, operators are more likely to achieve success by focusing on building capability and driving performance at a portfolio level rather than trying to drive and make sense of things at an individual service level. The reality is that unprofitable services, loss leaders and services that round out and maintain the overall customer experience can be as important as profitable ones.

A final point to make is that, while initial use of mobile is an important factor influencing service uptake, it is by no means the only one. Factors such as lifestyle and attitude towards mobile play a big part in shaping the way people use mobile services, as does the device itself. These are big areas, and merit detailed discussion in their own right.

What they do illustrate, however, is the importance of tuning into the customer and managing the customer relationship effectively, to ensure a genuine win-win scenario.

Through our research and insights, we help bridge the gap between technology buyers and sellers.

Have You Read This?

Generative AI Checkpoint

From Barcode Scanning to Smart Data Capture

Beyond the Barcode: Smart Data Capture

The Evolving Role of Converged Infrastructure in Modern IT

Evaluating the Potential of Hyper-Converged Storage

Kubernetes as an enterprise multi-cloud enabler

A CX perspective on the Contact Centre

Automation of SAP Master Data Management