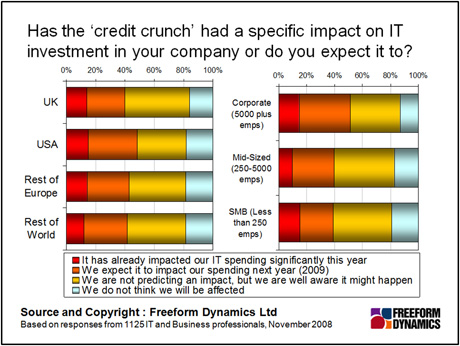

The economic outlook for many organisations has taken a decidedly frosty turn, as the figure below confirms. So the immediate debate now becomes just how severe and enduring the economic squeeze will be. It is likely that the majority of IT departments will be impacted to one degree or another over the coming year or two. Indeed, recent Freeform Dynamics research

suggests that while IT professionals are not panicking, four out of five acknowledge the likelihood of IT investments being hit.

Figure 1. Views are remarkably consistent across major geographies and organisation sizes.

The relatively good news is that, unlike the last crash, in 2001, which brought the dot-com spending frenzy to a sudden and painful halt, it looks as if CIOs and senior business managers are giving themselves time to think and plan this time around. Furthermore, the general view is that IT departments are, on the whole, better prepared to handle ‘adjustments’ in a controlled and objective manner, having adopted a more measured and business-oriented approach to spending as things recovered during the last four years.

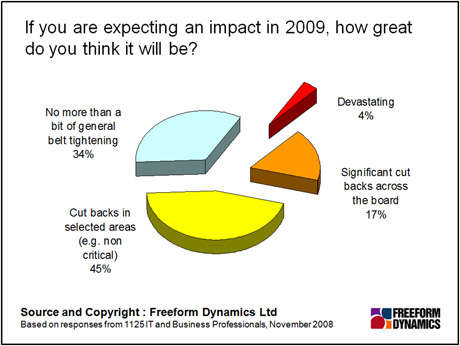

It should also be noted that, in 2001, if a business manager was asked just how far the daily operations were dependent on IT systems the likelihood is that an answer of “very” would be delivered only after considerable thought. Today all levels of management understand just how difficult, if not impossible, everyday business life becomes when IT systems are not operating effectively. To a degree this intimate dependence of routine business functions on IT service delivery should help ensure that IT does not bear a disproportionate burden when it comes to any budget adjustments. Figure 2 below lends some credence to this view.

Among those organisations that are anticipating impacts on their IT budgets, fewer than 20 percent foresee these to be significant. For the majority, “general belt tightening” or “carefully targeted reductions” is what appears to be on the cards. Exploring ways of reducing internal IT costs is important but significant work has already been undertaken to address this issue. Today more can be achieved by helping business users optimise the way they exploit IT and, potentially, by introducing new IT capability to enable the business itself to become more efficient and to find ways to increase the profitable revenue in tough market conditions.

Although running against expectations, many of the actions that are likely to make sense may require some investment. Whether it’s virtualisation solutions and management to enhance efficiency, desktop refresh initiatives to reduce ongoing costs and the burden of maintenance and support, or advanced communications to drive workforce level efficiency, a few well-qualified tactical investments now will deliver business benefits going forward.

Figure 2. The majority of those who are expecting a hit anticipate being able to contain the impact on IT through selective cut backs and/or some general belt-tightening.

Among the projects mentioned above, desktop management is expected to finally become a highly visible issue to management boards in a way that it should always have been but has never quite achieved. Several factors lie behind this reasoning, not least of which is that all businesses seek transparency in all areas of IT service delivery. As mentioned above, focus on many areas of IT expenditure has already resulted in significant falls in operational expenditure. The one area that has, so far, avoided close budgetary scrutiny has been the cost of delivering desktop, and increasingly, laptop and smartphone services.

The recent announcement by Microsoft of the release of early versions of its Windows 7 desktop operating system, coupled with new means of virtualizing and delivering centrally managed desktops, offers significant scope for the deployment of desktop services using novel approaches, all of which promise to reduce significantly the cost of desktop services while enhancing service levels. 2009 may not see a huge burst of new virtualised desktop deployments but investigation of new approaches is likely to begin.

On a final note, the availability of capital in today’s financial markets is likely to throw some attention onto alternate sources of IT financing. However, while the grip of the credit crunch shows few signs of softening in the immediate future, the financing arms of larger IT vendors are generally in much better shape. Indeed recent conversations with the usual suspects, including IBM, HP and Microsoft amongst others, confirm they are in a good position to help creditworthy customers in a variety of ways. It is therefore worth approaching players like these, and possibly newer players such as Smartfundit.com, either directly or via their partners, to explore the financing options that might be available. These vendors and sources of dedicated IT financing can provide traditional, although still underappreciated, offerings such as leasing but can also on occasion offer full blown project financing potentially covering all of the hardware, systems software, applications and services necessary to deliver a solution.

Through our research and insights, we help bridge the gap between technology buyers and sellers.

Have You Read This?

From Barcode Scanning to Smart Data Capture

Beyond the Barcode: Smart Data Capture

The Evolving Role of Converged Infrastructure in Modern IT

Evaluating the Potential of Hyper-Converged Storage

Kubernetes as an enterprise multi-cloud enabler

A CX perspective on the Contact Centre

Automation of SAP Master Data Management

Tackling the software skills crunch