by Dale Vile

The gobbling up by Oracle of BEA, the last significantly sized independent middleware vendor, is another sign of the trend we are seeing towards increasing consolidation in the IT industry. It leads to obvious questions about customer choice, disruption, and protection of investment that will sound very familiar to those impacted by previous acquisitions such as Oracle’s less than harmonious takeover of PeopleSoft in the ERP space.

While pundits and commentators speculate on how this latest consolidation event will pan out, we thought we would test the sentiment within the buyer and user community itself. To this end, shortly after the announcement of the acquisition, we conducted an online survey to gather views on whether the news was positive or negative for the industry and individual customers, providing respondents with the ability to express their thoughts freely as part of the exercise.

Almost three hundred responses were received in total, with over 80% coming from organisations with an investment in Oracle, BEA or both technologies. Most respondents were customers, though a few partners of the two firms also participated in the survey.

Good for the industry?

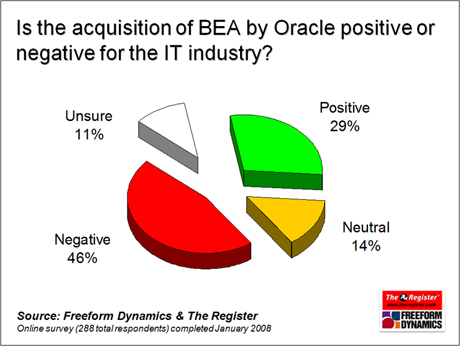

On the question of whether the acquisition was good for the industry, a range of views were received, with significant numbers of both positive and negative responses. On balance, however, as we can see from the chart below, the negative view predominates.

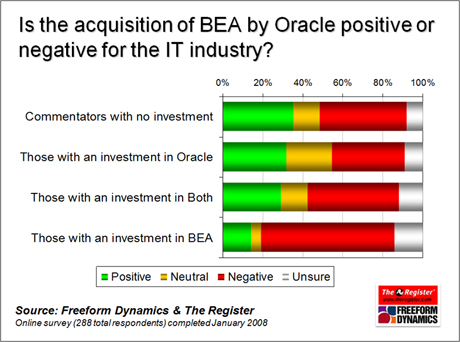

We should point out at this stage that polls of this nature tend to be biased towards the more extreme views that exist, as those who heard the news of the acquisition and just thought “So what?” would be less inclined to express an opinion. Nevertheless, it does provide an indication of the general skew of opinion, and we can also learn a lot by looking at what’s behind the headline numbers. Breaking the results out according to respondents’ existing investments, for example, tells us that the BEA customer base is taking the news far worse than Oracle-only or joint customers:

This reaction within the BEA customer base is hardly surprising given the uncertainty that is created when another player assumes control of one of your key suppliers. Concerns about the risk to existing investments and having a new supplier thrust upon you that you wouldn’t necessarily choose of your own accord were commonly expressed in the freeform feedback. Comments were also received from within the joint customer base complaining about dual supplier strategies for middleware being undermined, and fear of being at the mercy of a single mega-vendor like Oracle.

On the positive side, one of the strongest sentiments was that rescuing a genuinely enterprise class solution-set that was in danger of fading away was a good move for customers. Many felt that whilst BEA’s technology was good, the company itself was struggling to maintain its position, and that the power of a bigger player like Oracle that can duke it out quite happily with the likes of IBM and Microsoft was just what was required. This leads us to the biggest talking point around the Oracle/BEA deal – that of choice and competition – and there are two very different ways of looking at this.

Champion against Big Blue control, or the industry’s next Microsoft?

Considering relative capabilities in a bit more detail, some make the argument that while Oracle’s middleware solution was ‘good enough’ when the requirement was for an enabling component within an overall solution stack offering, it was certainly not up to head to head competition with IBM’s WebSphere for more strategic middleware requirements. With BEA lacking the necessary clout, SAP still largely viewed as proprietary, and other players not being large enough to make a huge difference outside of their respective niches, the danger was that IBM would run away with the J2EE application server and SOA market, particularly at the higher end. Injecting BEA’s heavyweight technical capability into the Oracle machine potentially neutralises this threat of IBM becoming too dominant.

Here are some examples of respondent quotes that relate to this argument:

“This will add pressure to the leader (IBM WebSphere). BEA was too small to compete. Oracle was not seen as a J2EE platform. Now, Oracle can drop its J2EE container and become a serious/credible competitor.”

“The acquisition of BEA means that Oracle is now a credible alternative to IBM.”

“It will turn up the heat on IBM [and is] overall a good thing for J2EE.”

“I believe a bit of consolidation is a good thing and should stamp out any of these ’extensions’ the likes of IBM want to put into future J2EE products providing M$ type lock-in.”

It has to be said, though, that around twice as many respondents focused on the negative side of the competition and choice dimension. Quotes such as these, for example, were much more common:

“This move shrinks the number of independent yet significant players in the IT industry.”

“My big problem with the continued consolidation of IT into mega corporations is that it stifles choice and innovation. “

“There is already too much consolidation in the industry, Oracle is mighty enough.”

“Reduces competition, places more power in the hands of an already massive player”

Building on these comments, perhaps those running the show from Redwood Shores that have milked Oracle’s positioning as an antidote to the Microsoft ‘evil empire’ should take heed from a stronger sentiment that has started to emerge. Some, it would seem, are finding it difficult to tell the difference between these two industry giants:

“We need Oracle to have more power, in the same way that Microsoft needs more power.”

“This move progresses Oracle towards being a monopoly.”

“Oracle is the new Microsoft. Embrace, extend, extinguish.”

The reality is that Oracle is nowhere near being overly dominant with any of its product lines in the same way that Microsoft dominates the desktop OS, office suite and email server markets. It needs to be very careful, however, that its anti-Microsoft rhetoric is not turned back on itself given the sensitivity that exists amongst customers to vendors accumulating too much power.

The bottom line for customers

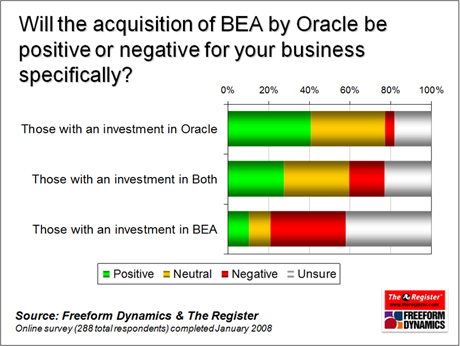

Speaking of customers, when respondents were asked about the impact of the acquisition on their own businesses, the difference between the various groups was even clearer:

Most of the reasons behind this picture have already been discussed, though there are a few that haven’t been mentioned yet, so here’s a list of commonly cited positive and negative themes ranked in order of frequency of mention:

NEGATIVE THEMES

1. Reduced choice and competition in the market

2. Uncertainties for customers with existing product investments

3. Loss of innovation, Oracle will smother the goodness of BEA

4. Concerns about Oracle as a supplier (style and nature)

5. Increased cost for BEA users (particularly maintenance)

6. Fear of lock-in as Oracle optimises between stack components

POSITIVE THEMES

1. A stronger and more mature solution will emerge (eventually)

2. Rescue of good technology from a company that had lost its way

3. Creation of stronger and more credible competition for IBM

4. Better synergy between BEA technology and Oracle RDBMS, tools, etc

5. Reinforcement of distinction between commercial offerings and OSS

6. More integrated approach to customers and account management

Meanwhile, Oracle has published some reassuring words to customers in an FAQ that can be found here. The message is essentially that “BEA products are expected to evolve into components of Fusion Middleware”, but that “Oracle will support BEA products in a similar manner to other recent Oracle acquisitions”.

Empty words? Well probably not, as customers of previously acquired solutions such as PeopleSoft and JD Edwards seem to have been looked after OK by Oracle. The company therefore really does have a reasonable track record of ‘doing the right thing’ in these acquisition scenarios to protect existing customers’ investments, even though the jury is still out on how well the parallel merging and integration of product lines is going under the Fusion Applications initiative. Arguably, though, the challenge of bringing together two standards-based middleware product lines is a bit less than working through multiple business level applications upon which customers’ business processes are so dependent.

In terms of customer action, there is not much than can be done at this stage other than wait for the details of Oracle’s plans to be fleshed out and communicated. Even if you are in the middle of evaluating options for a new project or investment, while you might want to ask a few additional questions around the commercials, the short term impact of the merger from a practical perspective is probably going to be pretty limited, so this shouldn’t necessarily hold up anyone’s tactical plans.

The only real consideration is at the level of strategic supplier choice. Some of those who looked to BEA because of its engagement model and independence from application level influences or other elements of the software stack may now look at IBM as the lesser of two evils, or reconsider some of the smaller specialists that currently retain their independent credentials.

In the meantime, we would like to thank all of those who participated in the survey and helped us to understand the various dimensions of this important industry development.

Dale is a co-founder of Freeform Dynamics, and today runs the company. As part of this, he oversees the organisation’s industry coverage and research agenda, which tracks technology trends and developments, along with IT-related buying behaviour among mainstream enterprises, SMBs and public sector organisations.

Have You Read This?

From Barcode Scanning to Smart Data Capture

Beyond the Barcode: Smart Data Capture

The Evolving Role of Converged Infrastructure in Modern IT

Evaluating the Potential of Hyper-Converged Storage

Kubernetes as an enterprise multi-cloud enabler

A CX perspective on the Contact Centre

Automation of SAP Master Data Management

Tackling the software skills crunch